Latest News

Via Benzinga · January 16, 2026

As the calendar turns to early 2026, the artificial intelligence landscape is no longer dominated solely by chatbots and image generators. Instead, the focus has shifted to the "ambient AI" on our faces. Meta Platforms Inc. (NASDAQ: META) has taken a decisive lead in this transition with the full rollout of its "Conversation Focus" feature—a [...]

Via TokenRing AI · January 16, 2026

AST SpaceMobile pushed meaningfully higher to print a record high of nearly $120 this morning after being picked as a prime contractor for the SHIELD program.

Via Talk Markets · January 16, 2026

The global artificial intelligence landscape has been fundamentally altered this week by what analysts are calling the "Efficiency Shock." DeepSeek, the Hangzhou-based AI powerhouse, has officially solidified its dominance with the widespread enterprise adoption of DeepSeek-V3.2. This open-weight model has achieved a feat many in Silicon Valley deemed impossible just a year ago: matching and, [...]

Via TokenRing AI · January 16, 2026

As the healthcare debate rages on, Mark Cuban offers industry insider insight on ongoing issues and how legislators could potentially solve it.

Via Barchart.com · January 16, 2026

Coca-Cola is shaking up its leadership and adding a new chief digital officer.

Via The Motley Fool · January 16, 2026

In a move that has sent shockwaves through Silicon Valley and global financial markets, NVIDIA (NASDAQ: NVDA) has effectively neutralized its most potent architectural rival. As of January 16, 2026, details have emerged regarding a landmark $20 billion licensing and "acqui-hire" agreement with Groq, the startup that revolutionized real-time AI with its Language Processing Unit [...]

Via TokenRing AI · January 16, 2026

Why Are State Street Shares Falling Today?stocktwits.com

Via Stocktwits · January 16, 2026

The ongoing strength in gold, silver, and copper is driven by long-term macro and industrial forces, not just short-term geopolitical headlines.

Via Talk Markets · January 16, 2026

The traditional role of the television as a passive display has officially come to an end. At CES 2026, Samsung Electronics Co., Ltd. (KRX: 005930) unveiled its most ambitious artificial intelligence project to date: the Vision AI Companion (VAC). Launched under the banner "Your Companion to AI Living," the VAC is a comprehensive software-and-hardware ecosystem [...]

Via TokenRing AI · January 16, 2026

February WTI crude oil (CLG26 ) on Friday closed up +0.25 (+0.42%), and February RBOB gasoline (RBG26 ) closed up +0.0014 (+0.08%). Crude oil and gasoline prices settled higher on Friday, recovering some of Thursday's sharp selloff. Geopolitical ri...

Via Barchart.com · January 16, 2026

The computing landscape has reached a definitive tipping point as the industry transitions from cloud-dependent AI to the era of "Agentic AI." With the dual launches of Intel Panther Lake and the AMD Ryzen AI 400 series at CES 2026, the promise of high-level reasoning occurring entirely offline has finally materialized. These new processors represent [...]

Via TokenRing AI · January 16, 2026

February Nymex natural gas (NGG26 ) on Friday closed down by -0.025 (-0.80%), Feb nat-gas prices settled lower on Friday but remained above Thursday's 3-month nearest-futures low. Abundant US supplies are weighing on nat-gas prices after Thursday's...

Via Barchart.com · January 16, 2026

General Atlantic has closed its investment into Odoo SA and taken on a minority stake in Odoo from Wallonie Entreprendre.

Via Benzinga · January 16, 2026

In a landmark shift for the intersection of consumer technology and geriatric medicine, Samsung Electronics (KRX: 005930) and Stanford Medicine have unveiled a sophisticated AI-driven "Brain Health" suite designed to detect the earliest indicators of dementia and Alzheimer’s disease. Announced at CES 2026, the system leverages a continuous stream of physiological data from the Galaxy [...]

Via TokenRing AI · January 16, 2026

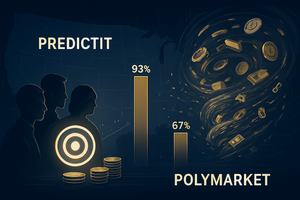

As of January 16, 2026, the United States prediction market ecosystem has shifted from a speculative niche into a cornerstone of the modern financial landscape. Once defined by the volatility of election cycles, the sector is now witnessing an institutional-grade transformation. According to a landmark analysis by Citizens Financial Group (NYSE: CFG) and a detailed [...]

Via PredictStreet · January 16, 2026

As of mid-January 2026, the landscape of broadcast journalism has fundamentally shifted. For decades, viewers tuned into news networks for opinions, expert "hot takes," and statistical polling that often lagged behind reality. That era ended this month. With the full-scale launch of landmark media partnerships between the regulated exchange Kalshi and news giants CNN (NASDAQ: [...]

Via PredictStreet · January 16, 2026

In a milestone that many researchers are calling the "biological equivalent of the moon landing," AlphaFold 3 has officially moved structural biology into a new era of predictive precision. Developed by Google DeepMind and its commercial sister company, Isomorphic Labs—both subsidiaries of Alphabet Inc. (NASDAQ: GOOGL)—AlphaFold 3 (AF3) has transitioned from a groundbreaking research paper [...]

Via TokenRing AI · January 16, 2026

OpenAI said it will soon start testing advertising on ChatGPT. Wall Street analysts have mixed views on the potential threat to Google.

Via Investor's Business Daily · January 16, 2026

Via Benzinga · January 16, 2026

As of January 16, 2026, the financial landscape has been permanently altered by a transition that many traditionalists once thought impossible: the full-scale integration of prediction markets into the daily habits of retail investors. What began as a high-stakes legal gamble in late 2024 has matured into a multi-billion dollar industry, with Robinhood Markets, Inc. [...]

Via PredictStreet · January 16, 2026

In a landmark shift that has redefined the trajectory of robotics and autonomous systems, NVIDIA (NASDAQ: NVDA) has solidified its dominance in the burgeoning field of "Physical AI." At the heart of this transformation is the NVIDIA Cosmos platform, a sophisticated suite of World Foundation Models (WFMs) that allows machines to perceive, reason about, and [...]

Via TokenRing AI · January 16, 2026

Micron continues to be one of the hottest stocks on the market.

Via The Motley Fool · January 16, 2026

Despite the influence of utility production, this was a positive report.

Via Talk Markets · January 16, 2026

As of January 16, 2026, the landscape of global prediction markets has undergone a seismic shift. For years, the industry was a two-horse race between the offshore, crypto-native Polymarket and the U.S.-regulated, institutional-grade Kalshi. Today, the results are in: the "financialization of sports" has crowned a new king. Driven by the explosive success of its [...]

Via PredictStreet · January 16, 2026

In a dramatic pivot from its original mission of "maximum truth" and minimal moderation, xAI—the artificial intelligence venture led by Elon Musk—has implemented its most restrictive safety guardrails to date. Effective January 16, 2026, the Grok AI model on X (formerly Twitter) has been technically barred from generating or editing images of real individuals into [...]

Via TokenRing AI · January 16, 2026

On January 12, 2026, the prediction market industry reached a historic milestone, processing a staggering $701.7 million in a single 24-hour trading session. This unprecedented volume represents a watershed moment for the sector, effectively transitioning event-based contracts from a niche curiosity into a primary "truth engine" for institutional and retail investors alike. The surge was [...]

Via PredictStreet · January 16, 2026

Trump advisor Peter Navarro said a potential tie-up between Ford and BYD could be troublesome for the EV sector and U.S. companies like Tesla.

Via Benzinga · January 16, 2026

In a move that fundamentally redefines the boundaries of intellectual property in the digital age, Academy Award-winning actor Matthew McConaughey has successfully secured a suite of federal trademarks for his voice, likeness, and iconic catchphrases. This landmark decision, finalized by the U.S. Patent and Trademark Office (USPTO) in early 2026, marks the first time a [...]

Via TokenRing AI · January 16, 2026

The "Little Market That Could" has finally grown up. As of January 16, 2026, the prediction market landscape looks radically different than it did just eighteen months ago. The most significant shift has not come from the arrival of new crypto-based giants, but from the rebirth of an industry pioneer: PredictIt. Following a grueling three-year [...]

Via PredictStreet · January 16, 2026

On January 16, 2026, the United States federal government officially entered the most aggressive phase of its domestic technology strategy with the implementation of the "Winning the Race: America’s AI Action Plan." This landmark initiative represents a fundamental pivot in national policy, shifting from the safety-centric regulatory frameworks of the previous several years toward a [...]

Via TokenRing AI · January 16, 2026

2026 will be a year for stock pickers.

Via The Motley Fool · January 16, 2026

The world of decentralized finance is no stranger to "whales" and high-stakes gambles, but a single series of trades executed in the final hours of January 2, 2026, has sent shockwaves through Washington and the global prediction market industry. Just hours before U.S. Special Operations forces launched "Operation Absolute Resolve" to capture Venezuelan leader Nicolás [...]

Via PredictStreet · January 16, 2026

BRUSSELS — The era of voluntary AI safety pledges has officially come to a close. As of January 16, 2026, the European Union’s AI Office has moved into a period of aggressive enforcement, marking the first major "stress test" for the world’s most comprehensive artificial intelligence regulation. In a series of sweeping moves this month, [...]

Via TokenRing AI · January 16, 2026

Robinhood stock price is stuck in a bear market after falling by nearly 30% from its highest level in 2025.

Via Talk Markets · January 16, 2026

In the corridors of power in Albany, a legislative storm is brewing that could redefine the boundaries between Wall Street and Las Vegas. Just four days ago, on January 12, 2026, the prediction market industry hit a staggering milestone: $701.7 million in total daily trading volume. This explosion in liquidity, fueled by the 2026 midterm [...]

Via PredictStreet · January 16, 2026

As of January 16, 2026, the transition of artificial intelligence from digital screens to physical labor has reached a historic turning point. Tesla (NASDAQ: TSLA) has officially moved its Optimus humanoid robots beyond the research-and-development phase, deploying over 1,000 units across its global manufacturing footprint to handle autonomous parts processing. This development marks the dawn [...]

Via TokenRing AI · January 16, 2026

Exploring the top movers within the S&P500 index during today's session.chartmill.com

Via Chartmill · January 16, 2026

Quantum computing is the bleeding edge of computer science and stands to solve AI's energy consumption problem. IonQ is an early leader in the industry.

Via The Motley Fool · January 16, 2026

In a move that signals the definitive arrival of event contracts as a mainstream asset class, Kalshi, the first regulated prediction market in the United States, has announced a staggering $1.1 billion Series E funding round. The investment values the New York-based exchange at $11 billion, catapulting it to "decacorn" status and marking one of [...]

Via PredictStreet · January 16, 2026

In a move that signals the definitive end of the "viral video" era and the beginning of the industrial humanoid age, Boston Dynamics has officially transitioned its all-electric Atlas robot from the laboratory to the factory floor. As of January 2026, a fleet of the newly unveiled "product-ready" Atlas units has commenced rigorous field tests [...]

Via TokenRing AI · January 16, 2026

In the wake of the most heavily traded political event in history, a landmark study from Vanderbilt University has sent shockwaves through the burgeoning prediction market industry. The report, titled "Prediction Markets? The Accuracy and Efficiency of $2.4 Billion in the 2024 Presidential Election," reveals a startling inverse relationship between raw capital and predictive precision. [...]

Via PredictStreet · January 16, 2026

In a landmark announcement at the 2026 Consumer Electronics Show, NVIDIA (NASDAQ: NVDA) has officially unveiled the Alpamayo platform, a revolutionary leap in autonomous vehicle technology that shifts the focus from simple object detection to complex cognitive reasoning. Described by NVIDIA leadership as the "GPT-4 moment for mobility," Alpamayo marks the industry’s first comprehensive transition [...]

Via TokenRing AI · January 16, 2026

Via Benzinga · January 16, 2026

Via Benzinga · January 16, 2026

Via Benzinga · January 16, 2026