News

Bitcoin is leading risk assets higher in an impressive Wednesday rally.

Via The Motley Fool · March 4, 2026

The financial landscape of 2026 is witnessing a profound shift in global capital as the "Emerging Markets Breakout" transitions from a technical signal to a full-blown market regime. For the first time in over fifteen years, the MSCI Emerging Markets Index has decisively cleared long-standing resistance levels, marking what analysts

Via MarketMinute · March 4, 2026

LQD’s vast corporate bond reach and liquidity set it apart from SCHQ’s Treasury focus, shaping distinct risk and diversification profiles.

Via The Motley Fool · March 4, 2026

If you're worried about downside risk right now, here are two smart choices.

Via The Motley Fool · March 4, 2026

Digital asset markets experienced a seismic shift today, March 4, 2026, as Bitcoin (BTC) successfully reclaimed and held the $73,000 psychological threshold. The move has sent shockwaves through the equity markets, specifically targeting firms with direct exposure to the blockchain ecosystem. Investors, fueled by a mixture of institutional momentum

Via MarketMinute · March 4, 2026

Bitcoin climbed to $73,000 on Wednesday as strong ETF inflows and improving traditional market sentiment boosted broader crypto momentum.

Via Benzinga · March 4, 2026

Explore how LQD’s broader bond mix and TLT’s Treasury focus shape risk, yield, and diversification for fixed income portfolios.

Via The Motley Fool · March 4, 2026

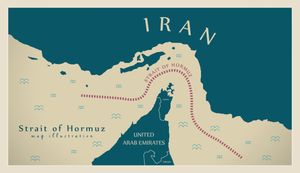

Is the Iran war a reason to change your investing strategy?

Via The Motley Fool · March 4, 2026

M.D. Sass launches its first ETF, the Concentrated Value ETF (SASS), seeding it with $70 million.

Via Benzinga · March 4, 2026

Bitcoin (CRYPTO: BTC) surged 7% in a single day move to $73,000, as heavy ETF inflows and improving technical structure combine to support price despite lingering macr

Via Benzinga · March 4, 2026

The iShares India 50 ETF hit a new 52-week low on Tuesday. While the impact of higher oil prices due to the Iran war hurts Indian companies more than most in Asia, this contrarian bet has historically been profitable.

Via Barchart.com · March 4, 2026

The original exchange-traded fund is still hugely popular.

Via The Motley Fool · March 4, 2026

Secret Iran Outreach Please click here for an enlarged chart of SPDR S&P 500 ETF Trust

Via Benzinga · March 4, 2026

Morgan Stanley (NYSE:MS) is expanding its crypto footprint, filing an S-1 with the U.S.

Via Benzinga · March 4, 2026

As oil surges on Middle East tensions, airline ETFs slide while energy funds gain —fueling a tactical long-energy, short-airlines trade.

Via Benzinga · March 4, 2026

Noble, a former associate of Fidelity’s Peter Lynch, said on Wednesday in a social media post that energy stocks were a good bet even before the geopolitical disruption from the ongoing war in Iran.

Via Stocktwits · March 4, 2026

The company also stated that it plans to introduce tokenized stocks in the future.

Via Stocktwits · March 4, 2026

According to a report from Reuters, the investment bank has said that it sees the correction risks in the market as a buying opportunity.

Via Stocktwits · March 4, 2026

Here's how to get exposure to thousands of stocks with a click of a button.

Via The Motley Fool · March 4, 2026

Bitcoin price pushed to month-high as ETF flows rebounded. Trump blamed banks for legislative delays. ARK buys these crypto stocks.

Via Investor's Business Daily · March 4, 2026

A simple low cost, two-ETF strategy would have beaten the vast majority of active managers over the past decade.

Via The Motley Fool · March 4, 2026

As of March 4, 2026, the American financial landscape is undergoing a tectonic shift, driven by the implementation of the "One Big Beautiful Act" (OBBBA). Signed into law on July 4, 2025, this sweeping tax reform has effectively dismantled the "sunset" anxiety that plagued corporate boardrooms for years. By restoring

Via MarketMinute · March 4, 2026

Via MarketBeat · March 4, 2026

His latest purchase is an interesting way to invest in the booming memory chip market.

Via The Motley Fool · March 4, 2026

CHICAGO — The silver market has entered a period of extreme volatility as the March 2026 COMEX delivery season begins, fueled by a precarious imbalance between physical supply and paper demand. As of March 4, 2026, market participants are closely monitoring the CME Group (Nasdaq: CME) and its ability to facilitate

Via MarketMinute · March 4, 2026