Latest News

The century-long tradition of Federal Reserve independence is facing its gravest threat to date as the Department of Justice (DOJ) has launched an unprecedented criminal investigation into Fed Chair Jerome Powell. The news, which broke on January 11, 2026, has sent shockwaves through global financial markets, raising fears that the

Via MarketMinute · January 16, 2026

Via Benzinga · January 16, 2026

In a move that signals a seismic shift for Wall Street’s most storied investment bank, Goldman Sachs (NYSE: GS) CEO David Solomon has officially signaled the firm’s intent to enter the rapidly maturing world of prediction markets. Speaking during the company’s Q4 2025 earnings call on January

Via MarketMinute · January 16, 2026

Via Benzinga · January 16, 2026

Via Benzinga · January 16, 2026

In a move that signals the definitive end of the "wild west" era of free, ad-free generative AI, OpenAI officially announced on January 16, 2026, that it will begin rolling out advertisements to ChatGPT for its US-based users. This pivot, which includes the launch of a new "ChatGPT Go" tier,

Via MarketMinute · January 16, 2026

In a move that has provided temporary breathing room for the world’s most valuable automaker, the National Highway Traffic Safety Administration (NHTSA) granted Tesla (NASDAQ: TSLA) a five-week extension on Friday, January 16, 2026. The reprieve concerns a high-stakes federal investigation into potential traffic-law violations by the company’s

Via MarketMinute · January 16, 2026

As the calendar turns toward late January 2026, a high-stakes standoff between the White House and the nation’s largest financial institutions has reached a breaking point. President Donald Trump has renewed his call for a mandatory 10% cap on credit card interest rates, setting a self-imposed deadline of January

Via MarketMinute · January 16, 2026

Via Benzinga · January 16, 2026

As the Federal Reserve grapples with a complex economic landscape in early 2026, Governor Michelle Bowman has delivered a striking shift in rhetoric, signaling that the central bank’s work in lowering interest rates is far from over. Speaking at the Outlook '26: The New England Economic Forum on January

Via MarketMinute · January 16, 2026

H.C. Wainwright double upgraded Iren to ‘Buy’ from ‘Sell’ with a price target of $80, up from $56.

Via Stocktwits · January 16, 2026

In a week defined by dramatic market divergence, the U.S. stock market has undergone one of its most significant structural shifts in years. As of January 16, 2026, a massive migration of capital is underway, moving from the high-flying technology giants that dominated the previous three years into "old

Via MarketMinute · January 16, 2026

New data shows that SMCI is the No. 3 most shorted stock by hedge funds. Here's what else to know about Super Micro Computer.

Via Barchart.com · January 16, 2026

Some AI-focused companies are not worth the trouble.

Via The Motley Fool · January 16, 2026

As the final tallies from the fourth-quarter earnings season roll in this January 2026, the verdict is clear: Wall Street’s titans have not just survived a period of economic uncertainty—they have thrived. Defying fears of a persistent slowdown, the largest U.S. financial institutions reported record-breaking annual revenues

Via MarketMinute · January 16, 2026

As of January 16, 2026, the global technology landscape has received a definitive signal that the artificial intelligence revolution is not only enduring but accelerating. Taiwan Semiconductor Manufacturing Company (NYSE:TSM) released its fourth-quarter 2025 financial results yesterday, shattering all previous records and single-handedly lifting market sentiment across the Pacific.

Via MarketMinute · January 16, 2026

Via Benzinga · January 16, 2026

Via Benzinga · January 16, 2026

Via Benzinga · January 16, 2026

Via Benzinga · January 16, 2026

Via Benzinga · January 16, 2026

Get insights into the top gainers and losers of Friday's after-hours session.chartmill.com

Via Chartmill · January 16, 2026

U.S. President Donald Trump has previously said that he was looking to introduce a one-year 10% cap on credit card interest rates after pointing out that the current rates were exorbitantly high.

Via Stocktwits · January 16, 2026

The market appeared to view the financing as strategic rather than defensive, given Broadcom’s strong cash generation and profitability profile.

Via Talk Markets · January 16, 2026

For investors looking to generate growth on $1,000, it could pay to look beyond the U.S.

Via The Motley Fool · January 16, 2026

Intel shares have soared heading into the firm’s earnings release on Jan. 22. But a Citi analyst and options traders believe INTC stock will push higher from here in 2026.

Via Barchart.com · January 16, 2026

Via Benzinga · January 16, 2026

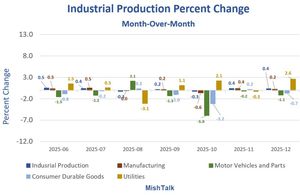

AI Boom. Utilities provided 88.8% of the increase in IP this month.

Via Talk Markets · January 16, 2026

JPMorgan CEO Jamie Dimon visited Palantir's DC offices on Thursday.

Via Benzinga · January 16, 2026

The tech giant is starting to show real momentum in streaming, and it has some structural advantages.

Via The Motley Fool · January 16, 2026

The S&P 500 Index ($SPX ) (SPY ) on Friday closed down -0.06%, the Dow Jones Industrials Index ($DOWI ) (DIA ) closed down -0.17%, and the Nasdaq 100 Index ($IUXX ) (QQQ ) closed down -0.07%. March E-mini S&P futures (ESH26 ) fell -0.06%, an...

Via Barchart.com · January 16, 2026

This crucial factor could determine whether CoreWeave stock soars or crashes over the next five years.

Via The Motley Fool · January 16, 2026

Kinderhook industries is closing its single-asset continuation vehicle for solid waste services, Ecowaste Solutions.

Via Benzinga · January 16, 2026

Viasat is not profitable. Is it really worth five times what it cost a year ago?

Via The Motley Fool · January 16, 2026

Sprouts Farmers Market runs stores nationwide, specializing in fresh, natural, and organic groceries for health-focused consumers.

Via The Motley Fool · January 16, 2026

The S&P 500 and Nasdaq settled slightly below breakeven on Friday, as all three major benchmarks succumbed to weekly losses.

Via Talk Markets · January 16, 2026

Via Benzinga · January 16, 2026

The trading activity of members of Congress continues to draw interest from retail traders and political analysts, with the Benzinga Government Trades page breaking down the latest disclosures from elected officials.

Via Benzinga · January 16, 2026

One of the hallmarks of the Israeli economy is its great resilience during the past two years as it dealt with wars on all its borders.

Via Talk Markets · January 16, 2026

Regional banking company BOK Financial (NASDAQ:BOKF) reported Q4 CY2025 results topping the market’s revenue expectations, with sales up 12.2% year on year to $589.6 million. Its GAAP profit of $2.89 per share was 33.3% above analysts’ consensus estimates.

Via StockStory · January 16, 2026

While Wall Street’s consensus forecasts often grab the headlines, it’s the unexpected twists - the “black swan” events and outlier scenarios - that can truly upend markets.

Via Talk Markets · January 16, 2026

According to a Bloomberg report, the new venture would house Radiate’s Astound as well as Google’s fiber optic Internet service, GFiber.

Via Stocktwits · January 16, 2026

Opendoor and Nextpower could generate significant gains over the next decade.

Via The Motley Fool · January 16, 2026

Active ETFs could face new costs as JPMorgan flags a $500M opportunity for Schwab to charge ETF issuers for data, marketing and platform access.

Via Benzinga · January 16, 2026

Silver’s vertical moonshot has accelerated into a dangerous extreme parabola. This popular speculative mania fueling frenzied fear-of-missing-out buying will end badly, like all before it.

Via Talk Markets · January 16, 2026

It's hard to beat Vanguard's S&P 500 ETF.

Via The Motley Fool · January 16, 2026

Shares of clinical research company Fortrea Holdings (NASDAQ:FTRE)

jumped 4.8% in the afternoon session after Evercore ISI upgraded the stock to Outperform from In Line and significantly raised its price target to $25 from $14.

Via StockStory · January 16, 2026