Microsoft (MSFT)

400.78

+7.11 (1.81%)

NASDAQ · Last Trade: Feb 7th, 3:27 AM EST

Detailed Quote

| Previous Close | 393.67 |

|---|---|

| Open | 399.17 |

| Bid | 403.00 |

| Ask | 403.30 |

| Day's Range | 392.92 - 401.79 |

| 52 Week Range | 344.79 - 555.45 |

| Volume | 53,515,311 |

| Market Cap | 3.02T |

| PE Ratio (TTM) | - |

| EPS (TTM) | - |

| Dividend & Yield | 3.640 (0.91%) |

| 1 Month Average Volume | 39,815,344 |

Chart

About Microsoft (MSFT)

Microsoft is a leading global technology company known for its software products, services, and hardware devices. The company is best recognized for its Windows operating systems and the Microsoft Office suite, which facilitates productivity and collaboration for users worldwide. In addition to software, Microsoft also offers cloud computing services through its Azure platform, enabling businesses to leverage scalable and flexible computing resources. The company is actively involved in various sectors, including gaming with its Xbox platform, artificial intelligence, and cybersecurity, continually innovating and expanding its product offerings to meet the diverse needs of consumers and enterprises. Read More

News & Press Releases

UiPath has flown under the media's radar despite some heavy Wall Street investment late last year, is it worth a look?

Via The Motley Fool · February 7, 2026

SemiAnalysis President Doug O'Laughlin criticized Microsoft's AI competitiveness while praising Amazon Web Services' scale and infrastructure execution.

Via Benzinga · February 7, 2026

Investing doesn't have to be complicated.

Via The Motley Fool · February 7, 2026

Quantum computing is an exciting opportunity, but the technology is young, and the pure plays are still highly risky investments. Fortunately, you don't need to swing for the fences with your stock picks to win.

Via The Motley Fool · February 6, 2026

There's growing debate over a possible AI bubble.

Via The Motley Fool · February 6, 2026

Iren's pivot from Bitcoin mining to Microsoft-backed AI infrastructure is redefining its long-term narrative, today, Feb. 6, 2026.

Via The Motley Fool · February 6, 2026

NuScale Power's stock had some serious momentum behind it.

Via The Motley Fool · February 6, 2026

IonQ investors were happy to see the quantum company's stock recover along with the market.

Via The Motley Fool · February 6, 2026

The quantum computing stock is finally seeing green.

Via The Motley Fool · February 6, 2026

In a move that has sent shockwaves through Silicon Valley and Wall Street alike, Alphabet Inc. (NASDAQ: GOOGL) has unveiled a staggering capital expenditure outlook for 2026, signaling its intent to lead the next era of computing at any cost. Following its Q4 2025 earnings report, the tech giant announced

Via MarketMinute · February 6, 2026

The global financial landscape was upended this week following the announcement that Kevin Warsh, a former Federal Reserve Governor known for his skeptical stance on unconventional monetary policy, has been nominated to succeed Jerome Powell as the next Chair of the Federal Reserve. The news, which broke on the morning

Via MarketMinute · February 6, 2026

SEATTLE — Shares of Amazon.com, Inc. (NASDAQ:AMZN) plummeted more than 5% in early trading on Friday, February 6, 2026, following a fourth-quarter earnings report that showcased record-breaking revenue but also unveiled a staggering $200 billion capital expenditure plan for the coming year. While the tech giant beat analyst expectations

Via MarketMinute · February 6, 2026

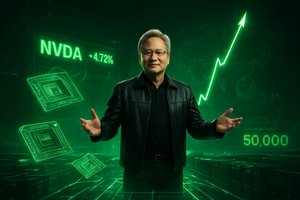

In a historic session for Wall Street, shares of Nvidia (NASDAQ:NVDA) surged more than 8% on Friday, February 6, 2026, breathing new life into the global technology trade. The rally was ignited by a high-stakes television appearance by CEO Jensen Huang, who declared that the demand for artificial intelligence

Via MarketMinute · February 6, 2026

In a historic display of market resilience and technological optimism, the Dow Jones Industrial Average closed above the 50,000-point milestone for the first time in history on Friday, February 6, 2026. The blue-chip index surged by a staggering 1,200 points during the session, ending the day at 50,

Via MarketMinute · February 6, 2026

From climate-focused screening to sheer market breadth, IEMG and NZAC take distinct paths to global diversification.

Via The Motley Fool · February 6, 2026

A number of stocks jumped in the afternoon session after the broader market rebounded from a tech-driven sell-off, with investors taking the opportunity to buy stocks at lower prices.

Via StockStory · February 6, 2026

Shares of aerospace and defense company Howmet (NYSE:HWM)

jumped 6.2% in the afternoon session after the broader market rebounded from a tech-driven sell-off, with investors taking the opportunity to buy stocks at lower prices.

Via StockStory · February 6, 2026

Shares of industrial products company CSW (NYSE:CSW)

jumped 5.4% in the afternoon session after the broader market rebounded from a tech-driven sell-off, with investors taking the opportunity to buy stocks at lower prices.

Via StockStory · February 6, 2026

The AI infrastructure play is set to benefit from a massive ramp in hyperscaler spending.

Via The Motley Fool · February 6, 2026

Shares of cloud computing and online retail behemoth Amazon (NASDAQ:AMZN)

fell 7.2% in the afternoon session after the company announced a massive $200 billion capital spending plan for 2026 and reported mixed fourth-quarter results.

Via StockStory · February 6, 2026

The State Street SPDR S&P 500 ETF Trust and the Vanguard Mega Cap Growth ETF may look similar at a glance, but they are built on very different return drivers. This comparison explains why that matters once markets move beyond a single leadership trend.

Via The Motley Fool · February 6, 2026

The cloud landscape has always been dynamic, but current shifts are tightening the race.

Via The Motley Fool · February 6, 2026

Shares of leading designer of graphics chips Nvidia (NASDAQ:NVDA)

jumped 7.8% in the afternoon session after CEO Jensen Huang declared that the $660 billion tech industry investment in AI infrastructure is sustainable and justified.

Via StockStory · February 6, 2026

Shares of payment solutions provider WEX (NYSE:WEX) jumped 7.3% in the afternoon session after the company reported strong fourth-quarter results that surpassed expectations and issued a positive forecast for 2026.

Via StockStory · February 6, 2026

Shares of semiconductor designer Lattice Semiconductor (NASDAQ:LSCC) jumped 5.5% in the afternoon session after analyst sentiment turned positive on the company's strong position in the emerging field of post-quantum cryptography.

Via StockStory · February 6, 2026