Lyft, Inc. - Class A Common Stock (LYFT)

16.61

+0.00 (0.00%)

NASDAQ · Last Trade: Feb 10th, 7:30 AM EST

Detailed Quote

| Previous Close | 16.61 |

|---|---|

| Open | - |

| Bid | 16.61 |

| Ask | 16.70 |

| Day's Range | N/A - N/A |

| 52 Week Range | 9.660 - 25.54 |

| Volume | 4,153 |

| Market Cap | 595.16M |

| PE Ratio (TTM) | 43.71 |

| EPS (TTM) | 0.4 |

| Dividend & Yield | N/A (N/A) |

| 1 Month Average Volume | 14,210,638 |

Chart

About Lyft, Inc. - Class A Common Stock (LYFT)

Lyft Inc is a transportation network company that operates a popular ride-hailing platform, connecting passengers with drivers through its mobile app. The company provides a convenient and cost-effective way for individuals to request rides in real-time, offering a variety of transportation options to suit different needs. In addition to its core ride-hailing services, Lyft also focuses on sustainable transportation solutions, including bike and scooter rentals, and has made efforts to expand its offerings to include partnerships in autonomous vehicle technology and public transportation initiatives. Lyft aims to enhance urban mobility while promoting a more environmentally friendly approach to transportation. Read More

News & Press Releases

Lyft is expected to report a 13% rise in its Q4 sales when it reports on Tuesday; Uber reported 20% growth in the December quarter last week.

Via Stocktwits · February 10, 2026

Amazon’s $200 billion capex plan rattled Wall Street so much that even bull Dan Ives trimmed his target, despite AWS and ads still firing at full cylinders.

Via Barchart.com · February 9, 2026

Ride sharing service Lyft (NASDAQ: LYFT)

will be reporting earnings this Tuesday after market hours. Here’s what you need to know.

Via StockStory · February 8, 2026

Uber Technologies (NYSE: UBER) reported its fourth-quarter and full-year 2025 earnings this week, unveiling a financial performance that underscores its absolute dominance in the global mobility and delivery sectors. While the company achieved record-breaking revenue and user growth, the market’s reaction remained lukewarm, as investors balanced impressive operational metrics

Via MarketMinute · February 6, 2026

Tesla, Inc. (NASDAQ: TSLA) has officially signaled the end of its era as a mere high-volume electric vehicle manufacturer, reporting Q4 2025 earnings that exceeded analyst expectations while simultaneously doubling down on Elon Musk’s artificial intelligence ambitions. The company confirmed a strategic $2 billion investment into xAI, the artificial

Via MarketMinute · February 5, 2026

SAN FRANCISCO – Shares of Uber Technologies, Inc. (NYSE: UBER) fell 5.2% in early trading on February 5, 2026, following the release of its fourth-quarter 2025 financial results. Despite reaching record trip volumes and reporting a nominal beat on top-line revenue, the ride-hailing giant failed to convince investors that its

Via MarketMinute · February 5, 2026

Date: February 5, 2026 Introduction Once the poster child for the "growth at all costs" era of Silicon Valley, Uber Technologies (NYSE: UBER) has completed a metamorphosis that few industry observers thought possible a decade ago. Today, Uber is no longer just a ride-hailing app; it has evolved into a global logistics powerhouse and an [...]

Via Finterra · February 5, 2026

On Feb. 4, 2026, investors weighed booming revenue against weaker profit guidance and rising robotaxi investment at this mobility giant.

Via The Motley Fool · February 4, 2026

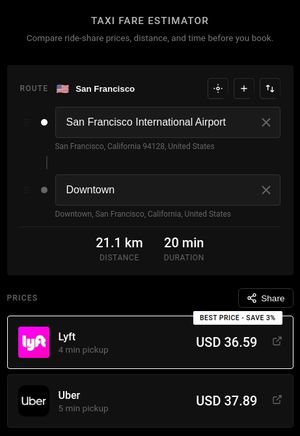

SAN FRANCISCO, CA - February 2, 2026 - Payfair (https://payfair.cash), a new rideshare price comparison platform, today announced the public launch of its free fare estimation tool that allows consumers to instantly compare Uber and Lyft prices before booking a ride.

Via AB Newswire · February 2, 2026

As of early February 2026, the identity of Tesla, Inc. (NASDAQ: TSLA) has undergone its most radical transformation since the launch of the Model S. Following a fiscal year 2025 that saw the company’s first-ever annual decline in both revenue and profit, CEO Elon Musk has doubled down on

Via MarketMinute · February 2, 2026

Tesla (NASDAQ: TSLA) shares rose by more than 3% in early trading on Monday, February 2, 2026, as investors reacted to a fourth-quarter earnings report that managed to exceed analyst expectations despite a cooling global electric vehicle market. The stock climbed to $430.41, bolstered by a significant improvement in

Via MarketMinute · February 2, 2026

Over the past six months, Lyft has been a great trade, beating the S&P 500 by 9.6%. Its stock price has climbed to $16.83, representing a healthy 19.5% increase. This run-up might have investors contemplating their next move.

Via StockStory · February 1, 2026

GLOBAL, Jan. 23, 2026 — KROOZ® (https://KROOZ.co | https://KROOZDriver.com), a global rideshare, technology, and transportation network company (TNC), today announced the continued worldwide expansion of its driver-owned mobility platform, now operating across 118 countries and providing rideshare transportation, cuisine and food delivery, and hot-shot package delivery services.

Via GlobePRwire · January 29, 2026

AUSTIN, Texas — As Tesla (NASDAQ: TSLA) reports its fourth-quarter 2025 earnings today, January 28, 2026, the company finds itself at the most critical juncture in its twenty-year history. Once defined by its dominance in the global electric vehicle (EV) market, the company is now fully rebranding itself as an artificial

Via MarketMinute · January 28, 2026

Today, Lyft, Inc. (Nasdaq: LYFT) announced that Deborah Hersman has joined Lyft’s Board of Directors, effective January 25, 2026. She has also been appointed as a member of the Nominating and Corporate Governance Committee of the Board.

By Lyft, Inc. · Via Business Wire · January 27, 2026

KROOZ® (https://KROOZ.co) is a global rideshare, technology, and transportation network company (TNC) built to transform how mobility and delivery services operate worldwide. KROOZ® provides rideshare transportation, cuisine and food delivery, and hot-shot package delivery services across 118 countries . View supported countries: https://mykrooz.com/countries

Via Get News · January 26, 2026

Wedbush analysts suggested "incremental caution" across the mobility, delivery and grocery sectors, heading into Q4 earnings.

Via Benzinga · January 26, 2026

In God Found Me in the Smoke: A Story of Grace in the Ashes, Dr. Jewell Honey- Love delivers a raw, unfiltered, and deeply spiritual memoir of survival, addiction, and faith that will resonate with anyone who has ever felt broken down, unseen, or beyond redemption.

Via AB Newswire · January 23, 2026

The announcement, which saw the company’s stock price jump 3.5% in midday trading, marks the first time the electric vehicle giant has permitted public riders to travel in vehicles with no human backup driver in the front seat. This milestone effectively transitions Tesla (NASDAQ: TSLA) from a traditional

Via MarketMinute · January 22, 2026

Vonage expands partnership with Freenow by Lyft, using silent authentication technology to strengthen security in ride-hailing industry.

Via Benzinga · January 22, 2026

Market swings can be tough to stomach, and volatile stocks often experience exaggerated moves in both directions.

While many thrive during risk-on environments, many also struggle to maintain investor confidence when the ride gets bumpy.

Via StockStory · January 21, 2026

Lyft, Inc. (Nasdaq: LYFT) (the “Company” or “Lyft”) will release financial results for the fourth quarter and full-year 2025 after the close of the market on Tuesday, February 10, 2026.

By Lyft, Inc. · Via Business Wire · January 20, 2026

Consumer internet businesses are redefining how people engage with the world by giving them instant connectivity and convenience. This influence cuts both ways though because they have high exposure to the ups and downs of consumer spending,

and the market seems to believe the tide is turning in the wrong direction -

over the past six months, the industry has tumbled by 1.9%. This performance is a noticeable divergence from the S&P 500’s 10% return.

Via StockStory · January 19, 2026

Lyft has finally stabilized its business, but does that make the stock a buy heading into 2026?

Via The Motley Fool · January 18, 2026

AI logistics moves, revenue growth, and valuation debates collide as investors reassess this superapp’s path, today, Jan. 15, 2026.

Via The Motley Fool · January 15, 2026