As the Q1 earnings season wraps, let’s dig into this quarter’s best and worst performers in the therapeutics industry, including United Therapeutics (NASDAQ:UTHR) and its peers.

Over the next few years, therapeutic companies, which develop a wide variety of treatments for diseases and disorders, face strong tailwinds from advancements in precision medicine (including the use of AI to improve hit rates) and growing demand for treatments targeting rare diseases. However, headwinds such as rising scrutiny over drug pricing, regulatory unknowns, and competition from larger, more resourced pharmaceutical companies could weigh on growth.

The 10 therapeutics stocks we track reported a mixed Q1. As a group, revenues beat analysts’ consensus estimates by 1.2%.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 8.4% since the latest earnings results.

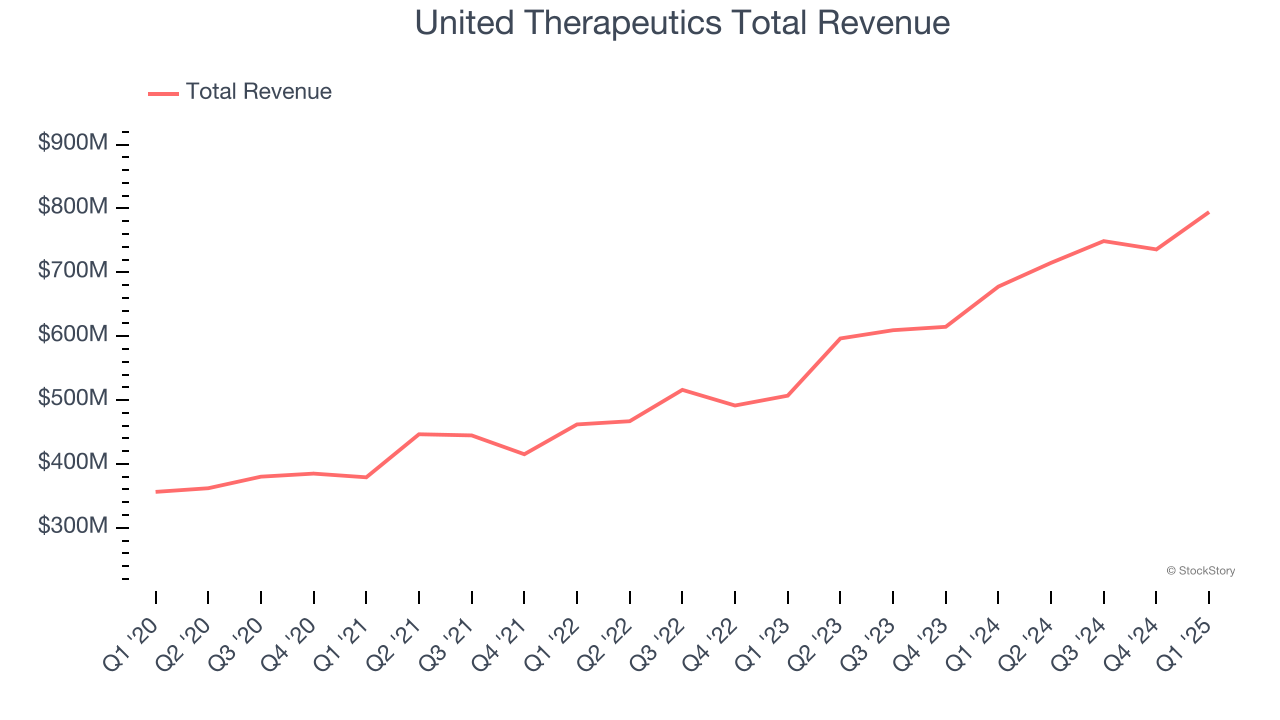

Best Q1: United Therapeutics (NASDAQ:UTHR)

Founded by a mother seeking treatment for her daughter's pulmonary arterial hypertension, United Therapeutics (NASDAQ:UTHR) develops and commercializes medications for chronic lung diseases and other life-threatening conditions, with a focus on pulmonary hypertension treatments.

United Therapeutics reported revenues of $794.4 million, up 17.2% year on year. This print exceeded analysts’ expectations by 5.6%. Overall, it was an exceptional quarter for the company with a solid beat of analysts’ EPS estimates.

“2025 is off to a tremendous start as we reported yet another quarter of record revenue,” said Martine Rothblatt, Ph.D., Chairperson and Chief Executive Officer of United Therapeutics.

Interestingly, the stock is up 7.8% since reporting and currently trades at $323.47.

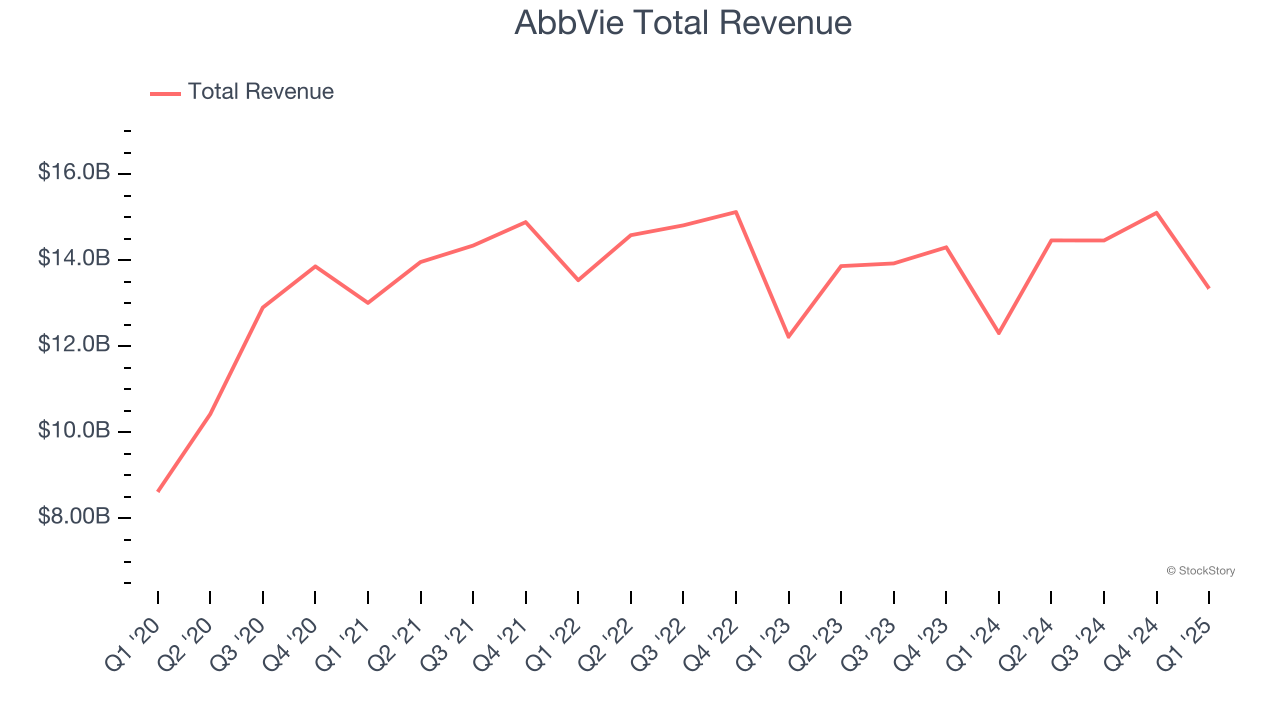

AbbVie (NYSE:ABBV)

Born from a 2013 spinoff of Abbott Laboratories' pharmaceutical business, AbbVie (NYSE:ABBV) is a biopharmaceutical company that develops and markets medications for autoimmune diseases, cancer, neurological disorders, and other complex health conditions.

AbbVie reported revenues of $13.34 billion, up 8.4% year on year, outperforming analysts’ expectations by 3.3%. The business had a very strong quarter with an impressive beat of analysts’ constant currency revenue estimates and a decent beat of analysts’ EPS estimates.

The market seems content with the results as the stock is up 4.9% since reporting. It currently trades at $189.29.

Is now the time to buy AbbVie? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Vertex Pharmaceuticals (NASDAQ:VRTX)

Founded in 1989 with a mission to create medicines that treat the underlying causes of disease rather than just symptoms, Vertex Pharmaceuticals (NASDAQ:VRTX) develops and markets transformative medicines for serious diseases, with a focus on cystic fibrosis, sickle cell disease, and pain management.

Vertex Pharmaceuticals reported revenues of $2.77 billion, up 3% year on year, falling short of analysts’ expectations by 2.3%. It was a disappointing quarter as it posted a significant miss of analysts’ EPS estimates and full-year revenue guidance slightly missing analysts’ expectations.

As expected, the stock is down 13.4% since the results and currently trades at $433.

Read our full analysis of Vertex Pharmaceuticals’s results here.

Moderna (NASDAQ:MRNA)

Rising to global prominence during the COVID-19 pandemic with one of the first effective vaccines, Moderna (NASDAQ:MRNA) develops messenger RNA (mRNA) medicines that direct the body's cells to produce proteins with therapeutic or preventive benefits for various diseases.

Moderna reported revenues of $108 million, down 35.3% year on year. This result lagged analysts' expectations by 8.4%. It was a softer quarter as it also logged full-year revenue guidance missing analysts’ expectations.

Moderna had the weakest performance against analyst estimates, slowest revenue growth, and weakest full-year guidance update among its peers. The stock is down 10.8% since reporting and currently trades at $25.50.

Read our full, actionable report on Moderna here, it’s free.

Sarepta Therapeutics (NASDAQ:SRPT)

Pioneering treatments for a devastating childhood muscle-wasting disease that primarily affects boys, Sarepta Therapeutics (NASDAQ:SRPT) develops and commercializes RNA-targeted therapies and gene therapies for rare genetic disorders, primarily Duchenne muscular dystrophy.

Sarepta Therapeutics reported revenues of $744.9 million, up 80.2% year on year. This print surpassed analysts’ expectations by 7.4%. Overall, it was a satisfactory quarter for the company.

Sarepta Therapeutics delivered the fastest revenue growth among its peers. The stock is down 21.5% since reporting and currently trades at $36.65.

Read our full, actionable report on Sarepta Therapeutics here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.