Dick's currently trades at $212 and has been a dream stock for shareholders. It’s returned 683% since May 2020, blowing past the S&P 500’s 107% gain. The company has also beaten the index over the past six months as its stock price is up 7.4%.

Is now still a good time to buy DKS? Or are investors being too optimistic? Find out in our full research report, it’s free.

Why Does Dick's Spark Debate?

Started as a hunting supply store, Dick’s Sporting Goods (NYSE:DKS) is a retailer that sells merchandise for traditional sports as well as for fitness and outdoor activities.

Two Things to Like:

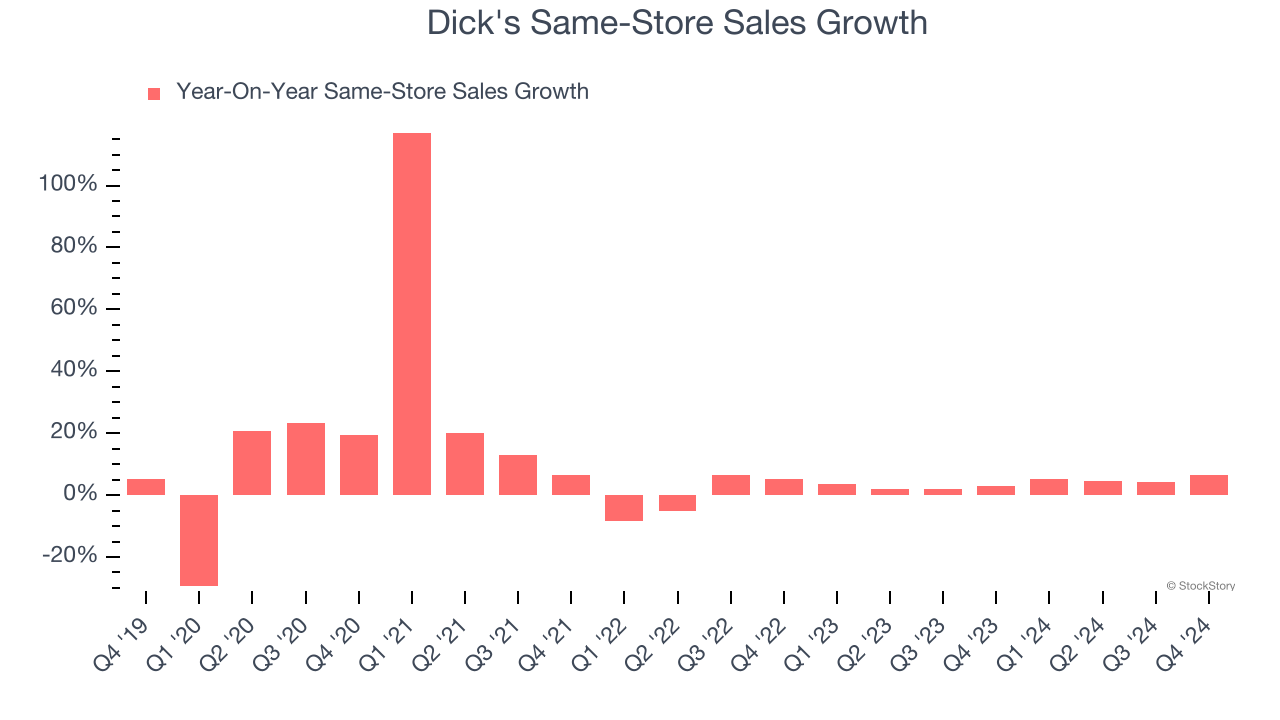

1. Surging Same-Store Sales Show Increasing Demand

Same-store sales is a key performance indicator used to measure organic growth at brick-and-mortar shops for at least a year.

Dick’s demand has been spectacular for a retailer over the last two years. On average, the company has increased its same-store sales by an impressive 3.9% per year.

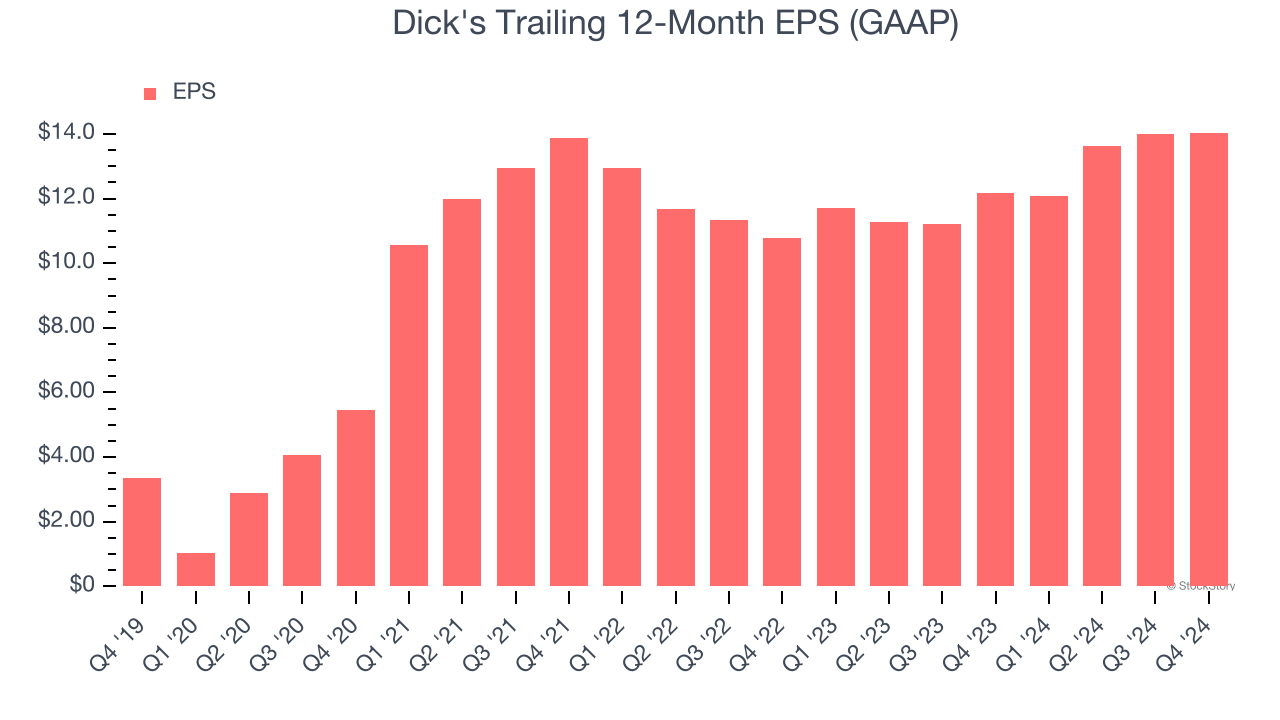

2. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Dick’s EPS grew at a remarkable 33.3% compounded annual growth rate over the last five years, higher than its 9% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

One Reason to be Careful:

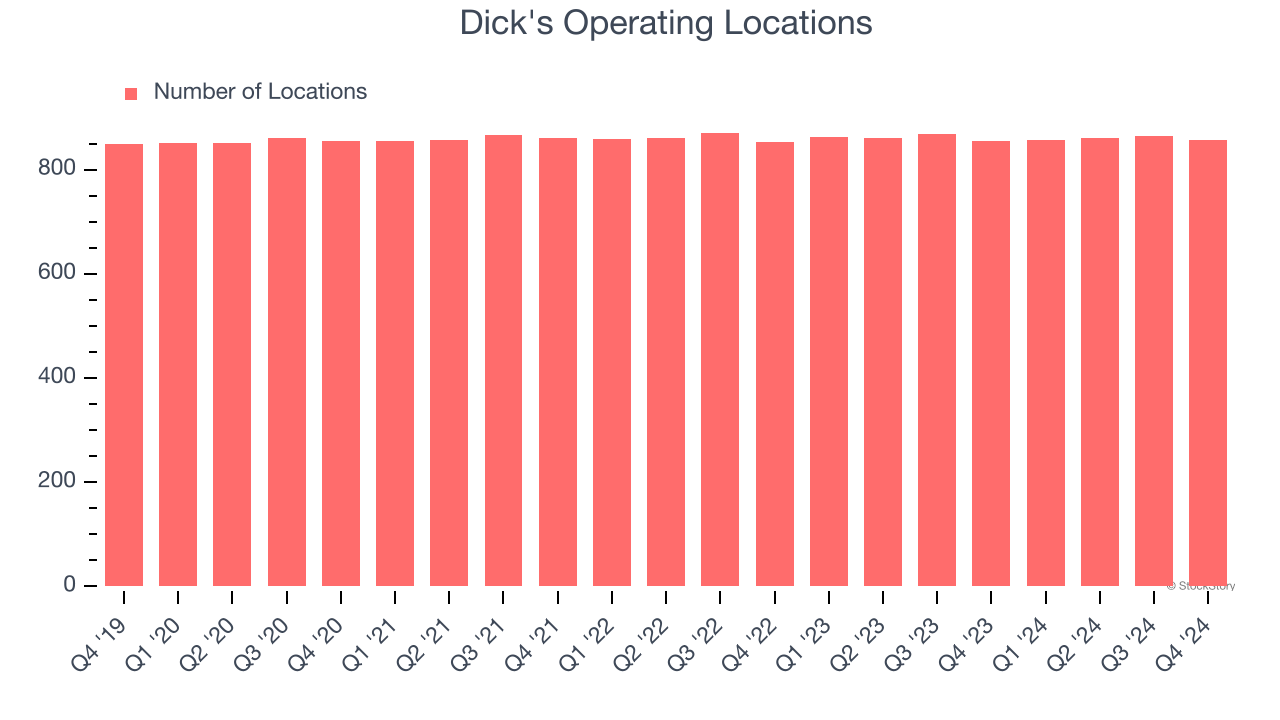

Lack of New Stores, a Headwind for Revenue

The number of stores a retailer operates is a critical driver of how quickly company-level sales can grow.

Dick's listed 856 locations in the latest quarter and has kept its store count flat over the last two years while other consumer retail businesses have opted for growth.

When a retailer keeps its store footprint steady, it usually means demand is stable and it’s focusing on operational efficiency to increase profitability.

Final Judgment

Dick’s merits more than compensate for its flaws, and with its shares topping the market in recent months, the stock trades at 14.4× forward P/E (or $212 per share). Is now a good time to buy? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than Dick's

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 176% over the last five years.

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.