First Quarter Revenue of $23.5 Million, Achieving the High End of Guidance Range of $21 – $24 Million

First Quarter Adjusted EBITDA Loss of $14.4 Million, Within Guidance Range of a Loss of $12 – $15 Million

Continued Strong Progress Against Transformation Plan

Company Issues Second Quarter 2025 Guidance and Reaffirms Full Year Guidance

May 13, 2025 — Surf Air Mobility Inc. (NYSE:SRFM) (the “Company”, “Surf Air Mobility”), a leading regional air mobility platform, today reported financial results for the first quarter ended March 31, 2025.

“During the first quarter of 2025, we continued to make strong progress across multiple initiatives in our Transformation Plan, achieving numerous milestones and keeping us on track to achieve profitability in our airline operations in 2025,” said Deanna White, Chief Executive Officer and Chief Operating Officer of Surf Air Mobility. “Our momentum is strong, and our operating metrics continue to improve as we optimize our aircraft fleet, implement new technologies and drive efficiencies.”

First Quarter Financial Highlights(1):

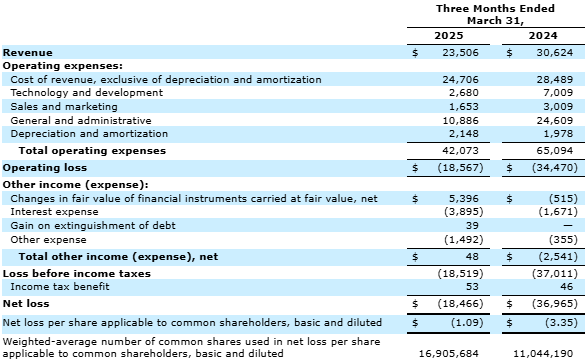

Revenue

- Revenue of $23.5 million for the first quarter of 2025 was at the high end of the Company’s expectation of $21.0 million – $24.0 million.

- Scheduled service revenue decreased by 23% over the comparable period primarily driven by the elimination of unprofitable routes and a brief interruption of service in January.

- On Demand service revenue decreased by 25% over the comparable period as the Company continues to focus on charter profitability.

Net Loss

- For the first quarter of 2025, the Company generated a net loss of $18.5 million as compared with a net loss of $37.0 million in the prior year period. The year-over-year reduction in net loss was primarily driven by lower technology-related costs, lower compensation costs, and a benefit from the change in fair value of financial instruments.

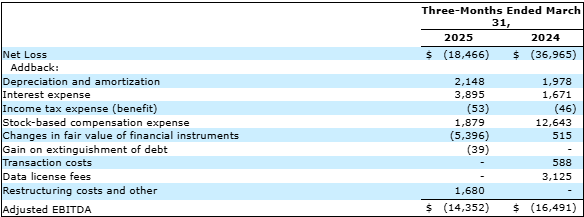

Adjusted EBITDA

- Adjusted EBITDA loss improved by $2.1 million, to $14.4 million for the first quarter of 2025 compared to a loss of $16.5 million for the same period of the prior year, within the guidance range of a loss of $12 million to $15 million. Adjusted EBITDA loss excludes the impact of stock-based compensation, changes in fair value of financial instruments, and other non-recurring items.

- First quarter 2025 Adjusted EBITDA loss reflects the deployment of capital raised in November towards clearing the aircraft maintenance backlog and continued investments in R&D.

- See the Adjusted EBITDA table for the reconciliation from Net Loss to Adjusted EBITDA.

(1) Results are unaudited.

Key Developments and Progress Against the Transformation PlanDuring the first quarter, the Company continued to make significant progress against its Transformation Plan.

Phase 2 – Optimization (2025-2026)

Milestones achieved during the first quarter on the Optimization phase of the Transformation Plan included:

Optimization of Airline Operations

- Completed the relocation of the Company’s System Operations Center to the Dallas/Fort Worth area

- Executed on our re-fleeting strategy by returning five older aircraft to their lessors

- Recruited senior aviation professionals to manage Part 135 operations

Recalibrating On Demand Business

- Launched a new Jet Card to simplify pricing options and broaden product offering

Driving Efficiencies from SurfOS

- Entered into agreements with six beta users of SurfOS

- Designed white label apps and frontend websites for certain beta customers to improve direct to consumer distribution

- Launched self-service flight changes and cancellations via chat, reducing the Company’s call center traffic by approximately 20%

- Introduced a mobile crew app that streamlines pilot workflows and time management for the Company’s airline operations, in compliance with FAA regulations

- Launched a weight and balance tool for the Company’s airline operations, in compliance with FAA regulations

- Expanded data platform to include data APIs with weather, census and entertainment events

Current Developments

The Company continues its efforts to execute against its Transformation Plan and, in the first six weeks of the second quarter, it has had the following additional achievements.

Phase 1 – Transformation

The first phase of the Transformation Plan was completed in 2024, however, during the second quarter, the Company achieved an incremental milestone:

- Secured $5 million in additional funding through a registered direct offering of common stock

Phase 2 – Optimization (2025-2026)

Optimization of Airline Operations

- Entered into an interline agreement with Japan Airlines to enable consumers to book our flights through Japan Airlines, expanding our access to 435 million consumers across our interline agreements

- Redesigned Pilot pay, domicile, work rules and resource plan

- Continued investment in fleet interior and exterior refurbishment

Recalibrating On Demand Business

- Signed volume purchase agreements to improve margins with two operators who are beta users of the SurfOS Operator platform

Driving Efficiencies from SurfOS, an AI-enabled software platform for the regional air mobility industry, developed with Palantir

- Completed the launch of Flight Docs to streamline maintenance processes

- Launched Flight and Crew Scheduling module of SurfOS within our operations

Financial Outlook

The Company noted that, at this time, it believes that tariffs will not have a significant impact on its financial results in 2025.

Second Quarter 2025

- Second quarter revenue in the range of $23.5 million to $26.5 million. These expectations reflect the exiting of unprofitable scheduled routes and a focus on profitability for the On Demand business.

- Adjusted EBITDA loss in the range of $10.0 million to $13.0 million, which excludes the expected impact of stock-based compensation, changes in fair value of financial instruments, and other non-recurring items. The Adjusted EBITDA loss range for the second quarter reflects the continued deployment of capital raised in November towards clearing the aircraft maintenance backlog and investments in R&D.

Full Year 2025

The Company continues to implement the Optimization phase of the Transformation Plan, which includes the optimization of its airline operations, the recalibration of its on-demand business, and efforts to drive efficiencies through the implementation of the SurfOS operating system. As previously disclosed, the Company has begun exiting unprofitable scheduled routes and is prioritizing profitability over revenue growth.

As a result, the Company reaffirms its expectations that 2025 revenues will exceed $100 million and that airline operations will achieve profitability, defined as positive adjusted EBITDA, in 2025.

Finally, as previously announced, the company is actively pursuing the creation of one or more joint ventures or partnerships with key vendors to separately capitalize the company’s electrification efforts and its software venture, Surf Air Technologies, that will capitalize on our exclusive agreement with Palantir to power SurfOS, the operating system for regional air mobility.

Conference Call

Surf Air Mobility will host a conference call today at 5:00 pm ET. Interested parties can register in advance to listen to the webcast here or can find a link on the ‘Events & Presentations’ section of our investor relations website.

Alternatively, listeners may dial into the call as follows:

North America – Toll-Free (800) 715-9871

International (Toll) – (646) 307-1963

Conference ID: 4775356

About Surf Air Mobility

Surf Air Mobility is a Los Angeles-based regional air mobility platform and one of the largest commuter airlines in the U.S. by scheduled departures. It is also the largest U.S. passenger operator of Cessna Caravans. In addition to its airline operations and On Demand charter services, Surf Air Mobility is developing an AI-powered software platform for the Regional Air Mobility industry. The company is also working to commercialize electrified aircraft and developing proprietary powertrain technology for the Cessna Caravan. Surf Air Mobility plans to offer its software and electrification solutions to the Regional Air Mobility industry to improve safety, efficiency, and profitability.

Forward-Looking Statements

This Press Release contains forward-looking statements within the meaning of The Private Securities Litigation Reform Act of 1995, including statements regarding the anticipated benefits of the credit facility; Surf Air Mobility’s implementation of its transformation strategy; travel trends; developments on key strategic initiatives; Surf Air Mobility’s profitability and future financial results; and Surf Air Mobility’s balance sheet and liquidity. Readers of this release should be aware of the speculative nature of forward-looking statements. These statements are based on the beliefs of Surf Air Mobility’s management as well as assumptions made by and information currently available to Surf Air Mobility and reflect Surf Air Mobility’s current views concerning future events. As such, they are subject to risks and uncertainties that could cause actual results or events to differ materially from those expressed or implied by such forward-looking statements. Such risks and uncertainties include, among many others: Surf Air Mobility’s future ability to pay contractual obligations and liquidity will depend on operating performance, cash flow and ability to secure adequate financing; Surf Air Mobility’s limited operating history and that Surf Air Mobility has not yet commercialized software platforms for third-party sales or manufactured any hybrid-electric or fully-electric aircraft; the powertrain technology Surf Air Mobility plans to develop does not yet exist; any accidents or incidents involving hybrid-electric or fully-electric aircraft; the inability to accurately forecast demand for products and manage product inventory in an effective and efficient manner; the dependence on third-party partners and suppliers for the components and collaboration in Surf Air Mobility’s development of hybrid-electric and fully-electric powertrains and its advanced air mobility software platform, and any interruptions, disagreements or delays with those partners and suppliers; the inability to execute business objectives and growth strategies successfully or sustain Surf Air Mobility’s growth; the inability of Surf Air Mobility’s customers to pay for Surf Air Mobility’s services; the inability of Surf Air Mobility to obtain additional financing or access the capital markets to fund its ongoing operations on acceptable terms and conditions; the outcome of any legal proceedings that might be instituted against Surf Air, Southern or Surf Air Mobility, the risks associated with Surf Air Mobility’s obligations to comply with applicable laws, government regulations and rules and standards of the New York Stock Exchange; and general economic conditions. These and other risks are discussed in detail in the periodic reports that Surf Air Mobility files with the SEC, and investors are urged to review those periodic reports and Surf Air Mobility’s other filings with the SEC, which are accessible on the SEC’s website at www.sec.gov, before making an investment decision. Surf Air Mobility assumes no obligation to update its forward-looking statements except as required by law.

Footnotes

Use of Non-GAAP Financial Measures: Surf Air Mobility uses Adjusted EBITDA to identify and target operational results which is beneficial to management and investors in evaluating operational effectiveness. Surf Air Mobility’s calculation of this non-GAAP financial measure may differ from similarly titled non-GAAP measures, if any, reported by other companies. This non-GAAP financial measure should not be considered in isolation from, or as a substitute for, financial information prepared in accordance with U.S. GAAP.

Non-GAAP financial measures have limitations in their usefulness to investors because they have no standardized meaning prescribed by GAAP and are not prepared under any comprehensive set of accounting rules or principles. In addition, non-GAAP financial measures may be calculated differently from, and therefore may not be directly comparable to, similarly titled measures used by other companies.

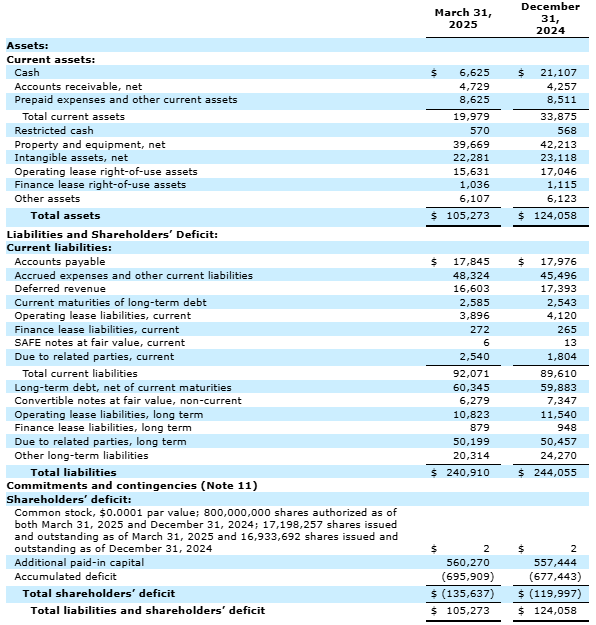

Unaudited Condensed Consolidated Balance Sheets as of March 31, 2025, and December 31, 2024:

Unaudited Condensed Consolidated Statements of Operations for the Three Months Ended March 31, 2025 and 2024: (in thousands, except share and per share data):

Unaudited Non-GAAP Financial Measures; Reconciliation of Net Loss to Adjusted EBITDA for the Three Months Ended March 31, 2025 and March 31, 2024 (in thousands):

Contacts:

For Press:

press@surfair.com

For Investors:

investors@surfair.com

Featured Image @ Freepik

Read more investing news on PressReach.com.Subscribe to the PressReach RSS feeds:- Featured News RSS feed

- Investing News RSS feed

- Daily Press Releases RSS feed

- Trading Tips RSS feed

- Investing Videos RSS feed

Follow PressReach on Twitter

Follow PressReach on TikTok

Follow PressReach on Instagram

Subscribe to us on Youtube